When your view on the markets goes bang on ! that’s when you get a feeling of real satisfaction, which might I add is far greater than any money made.

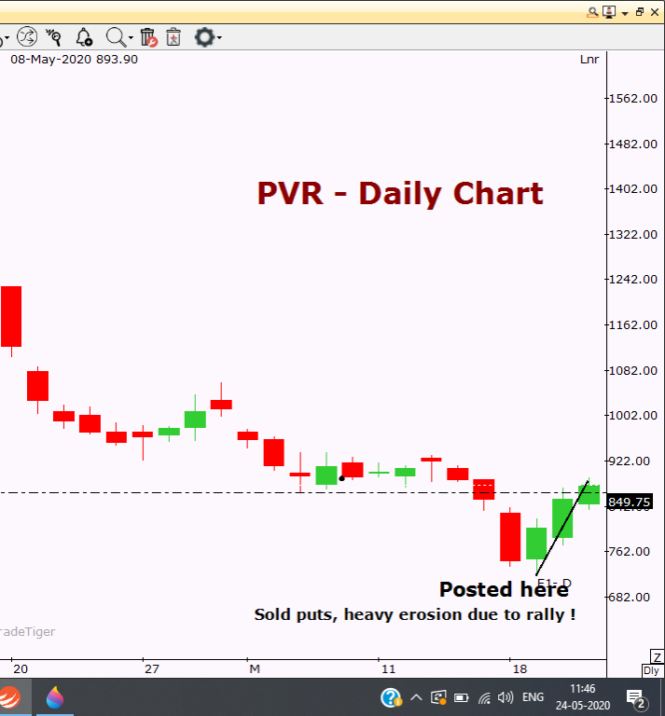

Few days back I had mentioned that I was looking to short OTM puts of PVR as I was expecting a rally in this stock, I had mentioned that the range I wanted to enter was 700 to 750. And hold and behold, PVR exactly came into our level of 700 to 750(Made a low of 718) & then bounced almost 25% from there.

All the OTM puts crashed in value by more than 60 to 70%. Be it the 550pe or the 500pe or the 650pe.

Secondly, We also expected than the markets would remain range bound for the past 2 weeks and analysed the data to interpret that the fall that might happen also will not be very deep. This is exactly what has played out to the ‘T’. Nifty went to a low 8806 to bounce back again 200 points. There were actually multiple factors to determine this. Let me take you through the most evident one that happened on the 18th. If you had looked at the 8500put of May on the day of the 8806 low (18th May’20) the last hour had selling in Nifty to a decent extent, but there was absolutely no increase in premiums of the puts. The 8500put of May stood like a monument on a windy day just refusing to budge. This showed that the big money was betting on the market bouncing from there. Once again, we were rewarded for our timely action and Nifty had a swift bounce from there.

Apart from this, our ITC low was also perfectly planned and I have even entered my first tranche in SBIN as mentioned in my previous post. Stay Tuned for the next post for some insights on the times ahead and a small jist into why did Bajaj Finance fall on Friday.